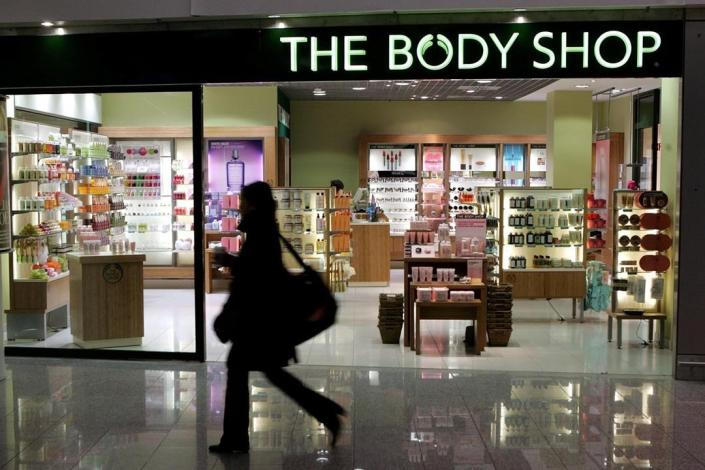

The Body Shop Canada Ltd., a well-known cosmetics brand, has recently filed for bankruptcy protection under the Bankruptcy and Insolvency Act. The company, which operates 105 stores across the country, is facing financial difficulties and has announced plans for a significant restructuring.

As part of its restructuring strategy, The Body Shop Canada will immediately close 33 of its stores, representing nearly a third of its retail locations. The affected stores are spread across various cities, including Toronto and Mississauga. Additionally, the company will suspend its e-commerce operations during this period.

While the exact number of job losses resulting from the store closures remains undisclosed, it is clear that this move will have implications for employees. The company aims to create additional breathing room through the restructuring process, allowing it to navigate the challenging economic landscape.

The Body Shop Canada’s decision reflects the broader challenges faced by the retail industry, especially during the ongoing economic uncertainties. As the company takes steps to reposition itself, customers and employees alike will closely watch its progress.

In summary, The Body Shop Canada’s restructuring efforts are aimed at securing its future viability and adapting to changing market dynamics. The brand’s loyal customers will undoubtedly hope for a successful turnaround in the coming months.

Comments

Post a Comment